Check out membership content:

President Trump's 100th day doesn't come until April 29. It feels like it's been more like 1,000 days. If you feel utterly confused and have no idea what's going on, know that you're not alone. Luckily, the markets can tell us a lot of information even when they are in a state of massive confusion.

What is clear is that the S&P 500 does not like the 5,450 level. There have now been four attempts to break out that have failed. There is nothing that stands out as special about that area from a technical standpoint, that I can tell, and I've tried looking at and measuring it from a few different angles.

The other thing it tells me is that my view that another leg lower started seems to be wrong, at least for now. However, the fact that 5,450 has been tested a few times and remains a wall is not a good sign for where the market is heading next.

Now that we have two lower gaps, I would guess that we fill the lower gap at 5,260.

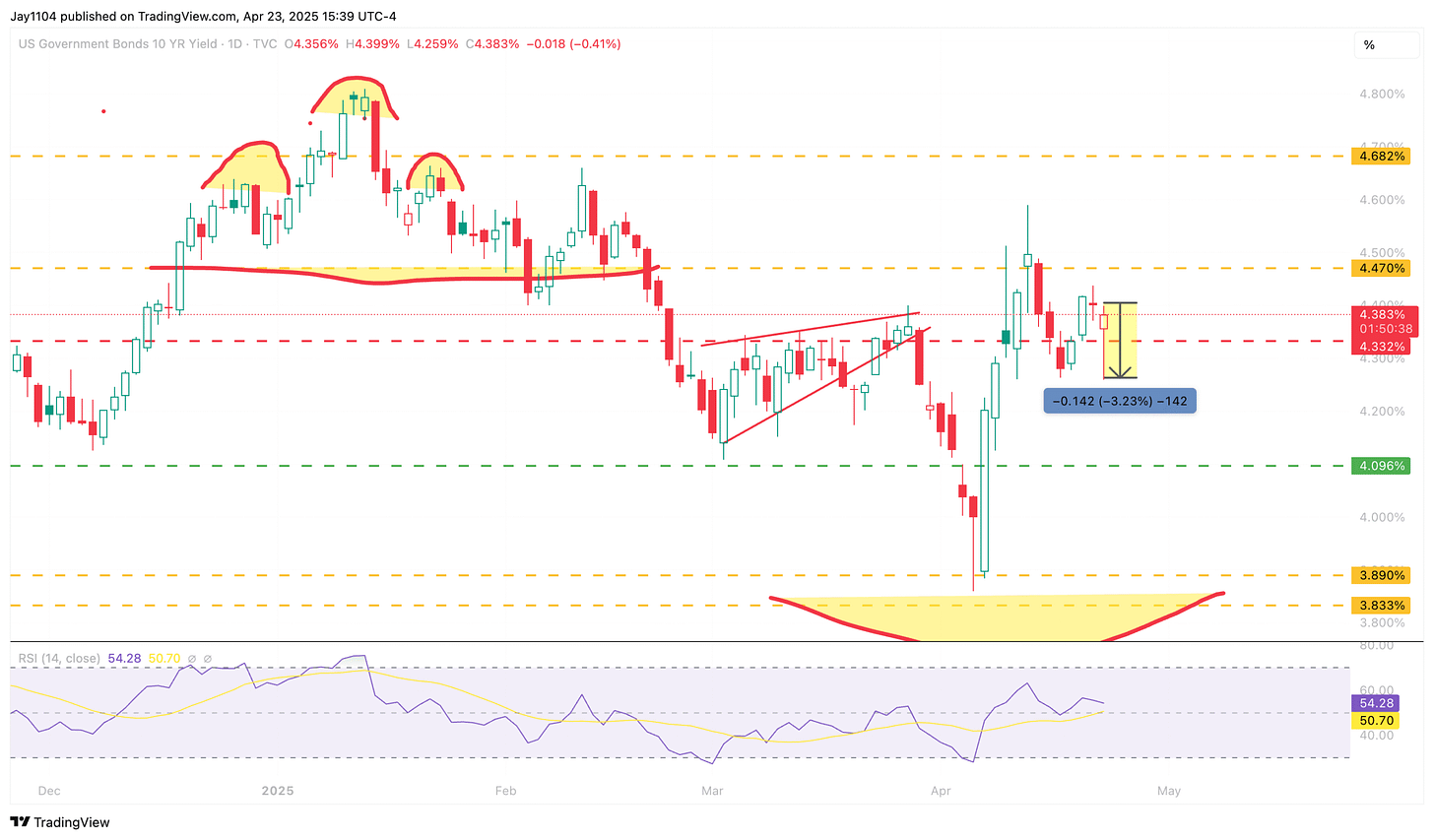

What is also probably not a good sign is that the 10-year Treasury finished the day down just two bps. It was like the little engine that could, and kept working all day long to pull itself up the hill, after it fell 15 basis points to start the day. That is quite the feat, and more impressively, it seems that many sellers prefer the 4.25% region. A lot has been thrown at this bond market - the kind of stuff that should send rates lower, too - yet they won't drop. I hate to say it, but that probably means rates are going to be heading much, much higher.

There could be a good reason for that, according to S&P Global, the US Flash PMI today noted that input costs in the manufacturing sector increased at the fastest rate since August 2022.

In the meantime, reverse repo activity has been picking up as expected, rising to $171 billion today, meanwhile, the TGA as of April 22 was at $606 billion. That would mean the TGA is down about $30 billion compared to last week's $638 billion, while the Reverse Repo Facility is up by around $120 billion, from last week's $54.7 billion. So I would guess that reserve balances are probably down about $90 billion this week, to about $3.2 trillion from last week's $3.28 trillion.

A significant amount of liquidity has been removed from reserves over the past two weeks.

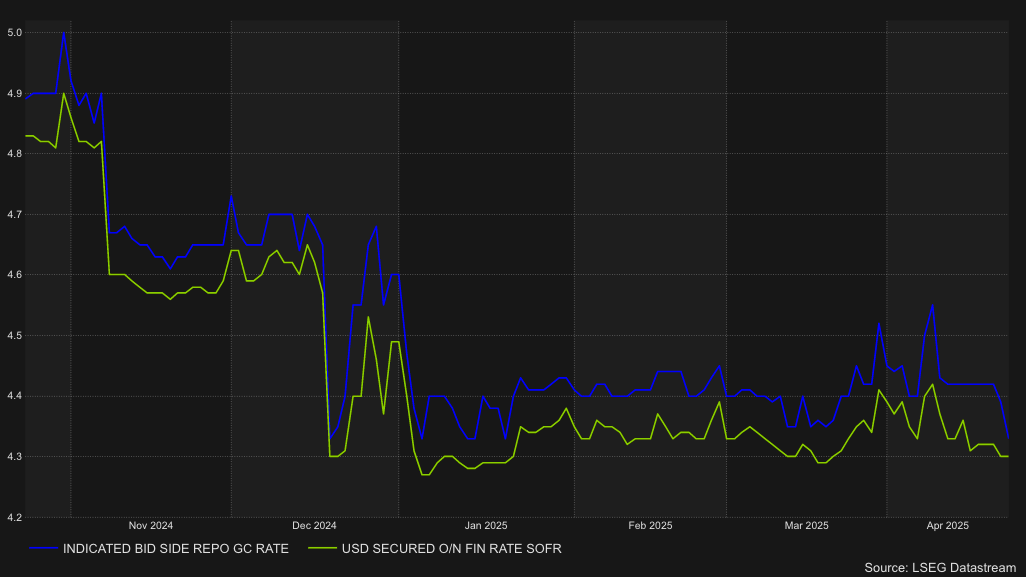

We tend to see general collateral rates fall this time of the month, and then begin to tighten up again by the end of the month. We saw the same thing heading into the end of March. But there are fewer reserves available today than there were a month ago, so I will keep an eye on SOFR in the mornings. The higher it goes, the tighter the liquidity conditions in the market. Things have been fairly loose the last couple of days.

-MIKE

TERMS BY CHATGPT:

SOFR (Secured Overnight Financing Rate) – A benchmark interest rate based on overnight loans secured by U.S. Treasury securities.

Reverse repo (repurchase agreement) – A financial transaction where the central bank sells securities with an agreement to repurchase them later, used to manage liquidity.

TGA (Treasury General Account) – The main checking account the U.S. Treasury uses at the Federal Reserve.

General collateral rates – Interest rates on short-term loans secured by general (non-specific) government securities, often used as a measure of market liquidity.

Leg lower – A term in market analysis referring to a downward movement in the price of an asset.

Basis points (bps) – A unit used in finance to describe percentage changes in interest rates or other values, where 1 bps = 0.01%.

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.