Today, we saw a move back into large-cap names as the S&P 500 rallied by about 60 bps, while the equal-weight RSP rallied by four bps. Yep, it feels like the stock market is a giant pool of waves that are going from one side of the pool to the other, with no real changes taking place.

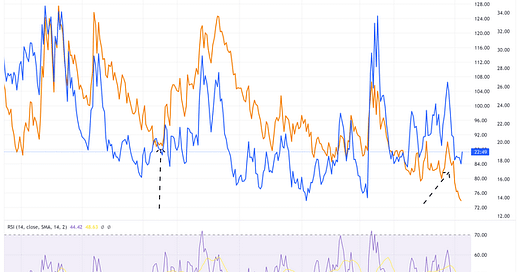

One thing that is certainly helping to provide the lift is that implied volatility levels on the VIX are down to 13.66 at the close, which are the lowest levels since before the pandemic.

On the flip side, the VVIX increased today. The VVIX measures the implied volatility of the VIX, and when the VVIX starts to rise, it can be a sign that the VIX is going to soon begin to rise.